Stock leverage calculator

Place a stop-loss order by calculating Liquidation point. Calculate projected returns at two targets.

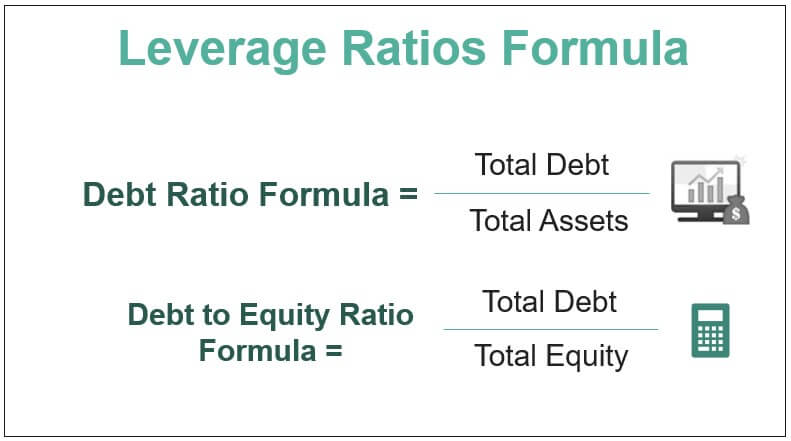

Leverage Ratios Formula Step By Step Calculation With Examples

Here is a quick demonstration of how to separate these two factors.

. For example if your investment were to lose all of its value you would not. If the stock price recovers to the 1st purchase price of 5000 the total value of the investment will become 1000000 from an initial investment of 600000. Stocks Under 1 2 5 10.

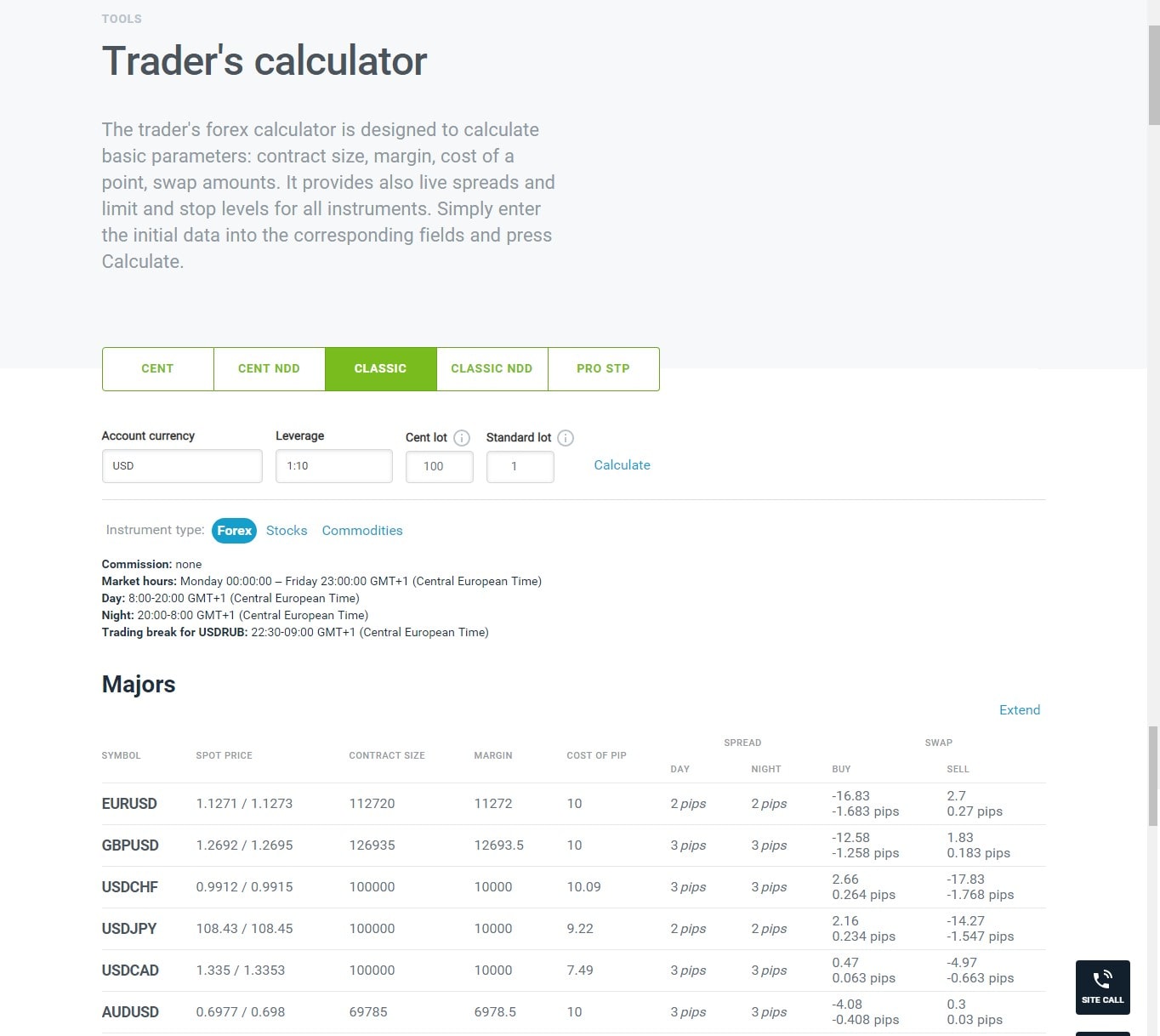

Stock brokers can accept securities as margin from clients only by way of pledge in the depository system wef. By using the same calculating parameters 301 leverage and a 010 lot trading position and if we choose the AUDUSD pair then we can see that the margin required to trade this pair would be much less only 18689 GBP. Find A Dedicated Financial Advisor.

Calculate safe leverage with respect to Liquidation point. This changes the cost basis from 5000 to 3000 which is a difference 2000 or 4000. A leverage ratio calculation is complex however with our forex leverage calculator you just need to input a few values and calculate it easily.

Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients. This is especially true while talking about the expected rate of return from an investment. Currency pair - the currency youre trading.

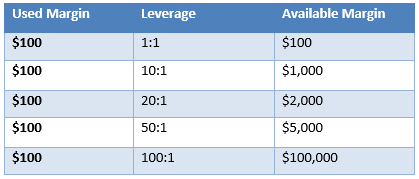

For every trade you take there are two components your margin capital and the leverage. Using debt as leverage to purchase investments can magnify your return. The downside is that you also increase your risk.

Ad Do Your Investments Align with Your Goals. You want to reduce the average stock price by buying more stocks but you need to calculate how many stocks you need to buy to make the average closer to the current price. Without knowing the margin requirement at different leverage ratios you might be throwing your entire account on one single position and if you are using.

Margin capital Your own deposited money. Volume 0 300000 500000. Margin - how much margin do you wish to use for the trade.

Get started by selecting a stock. Calculate the required amount or maintenance margin needed for investors to make securities purchase on margin. For instance when the price of assets in an account rises trading on margin allows investors to use leverage to increase their gains.

Margin for Equity intraday trades. Stock Trading Margin Calculator. Investment Loan Calculator Canadian This calculator helps illustrate the effect of using a loan to purchase an investment or appreciable asset.

Cost Leveraged 0. 5 Accredited Valuation Methods and PDF Report. Now the stock price has gone down to 150.

Our margin calculator automatically calculates the amount margin you need to keep in your account as insurance for opening new positions. Life Is For Living. Update your mobile number e-mail ID with your stock brokerdepository participant and receive OTP directly from depository on your email id andor mobile number to create pledge.

Lets say you buy 100 shares at 60 per share but the stock drops to 30 per share. In general leverage increases the rate of return. Learn How We Can Help.

Lets Partner Through All Of It. This would be a. The Leverage Margin Calculator can also be used to find the least expensive pairs to trade.

Lets say an investment grows in value from 1000 to 1200. Find a Dedicated Financial Advisor Now. You then buy another 100 shares at 30 per share which lowers your average price to 45 per share.

But you have faith that it will go upwards in future. The reason is mainly because a leveraged position is riskier compared to an unleveraged one. Stock Leverage Calculator A crucial part of leverage stock trading is to use a stock leverage calculator to calculate how much margin capital or collateral is needed to open your position.

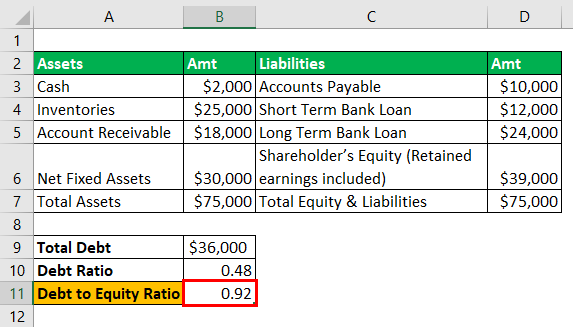

A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt loans or assesses the ability of a company to meet its. However when the prices of these assets fall. This stock average calculator tool added all the shares bought differently divided by the total amount used to buy those stocks.

Its the perfect way to manage your trades and work out the position size and the leverage level you need to stick to. Margin is the amount deposited by an individual in a Trading Account. Ad No Financial Knowledge Required.

A crypto leverage calculator is a tool that is used to calculate how much margin collateral or capital is needed to open your position. In order to transact more from the clients all stock broking firms provides Limit or Exposure over an above of the Margin deposited by Clients. Trade size - contract size or number of traded.

Lets take an example. Here comes this tool Share Average Calculator Stock Average Calculator by. Investment Loan Calculator Canadian This calculator helps illustrate the effect of using a loan to purchase an investment or appreciable asset.

If you buy a stock multiple times and want to calculate the average price that you paid for the stock the average down calculator will do just that. Reliable Valuation -Based on Market Data- to Increase the Success of Your Deal. Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts.

Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost. Account currency - your account deposit currency. One of the most important aspects of risk management in leveraged trading is to be able to calculate your own margin requirement for each position you open in forex stocks and commodity trading.

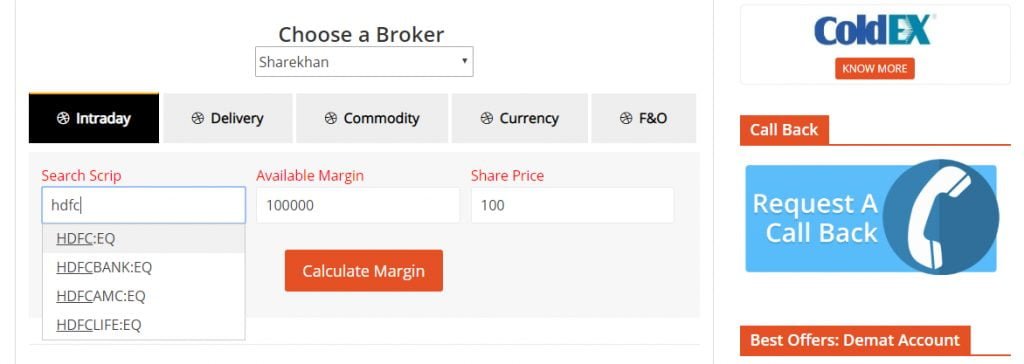

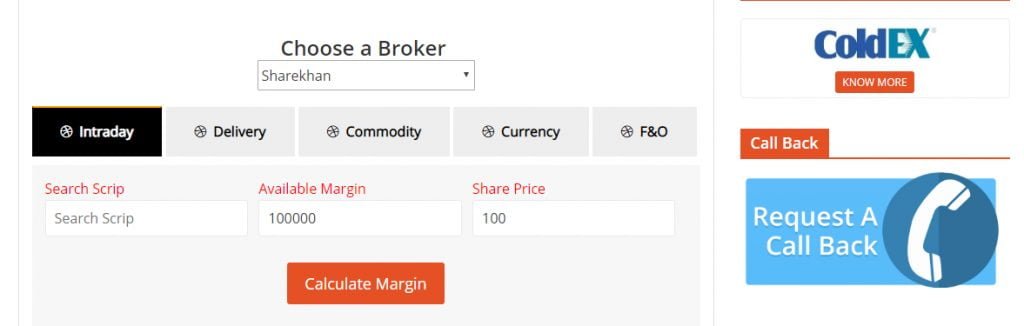

Margin Calculator helps in calculating the Exposure or Leverage of Individual Stock Brokers for all Asset Classes. Ad Objective-Based Portfolio Construction is Key in Uncertain Times. Finally the user gets the average down the.

In technical terms leverage is the ratio between the amount of money you have in your account and the total size of positions the broker.

Trading Scenario Margin Call Level At 100 And Stop Out Level At 50 Babypips Com

Leverage Calculator Myfxbook

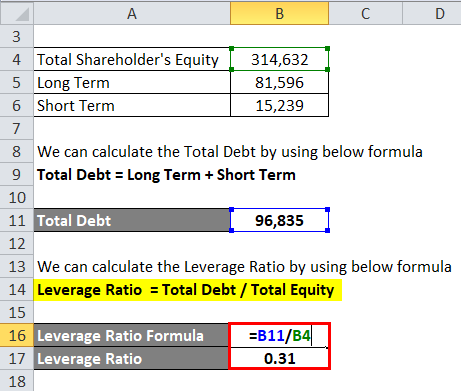

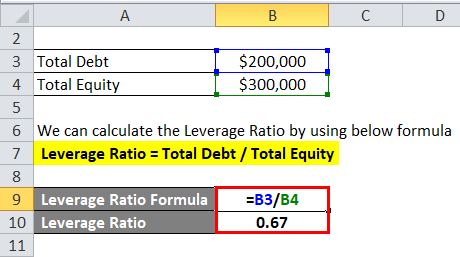

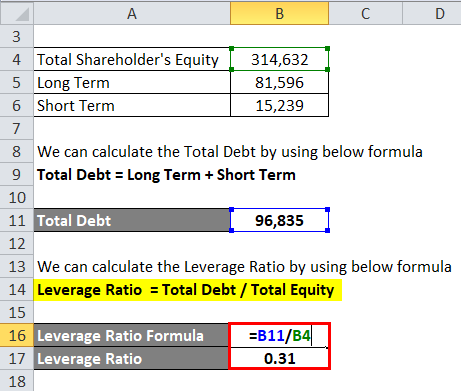

Leverage Ratio Formula Calculator Excel Template

Leverage Ratios Formula Step By Step Calculation With Examples

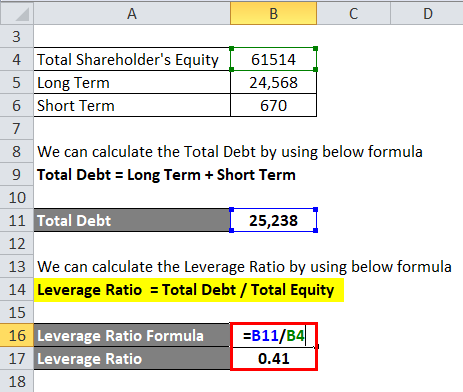

Leverage Ratio Formula Calculator Excel Template

How To Use A Forex Leverage Calculator Forex4you

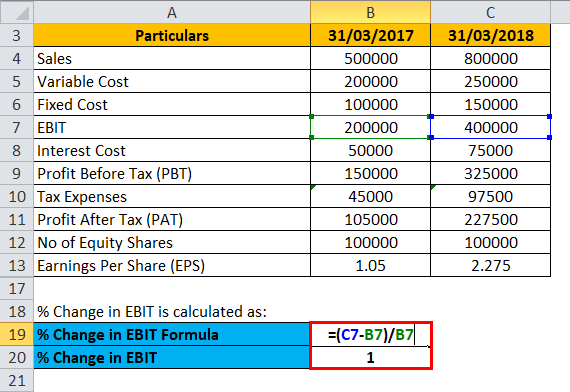

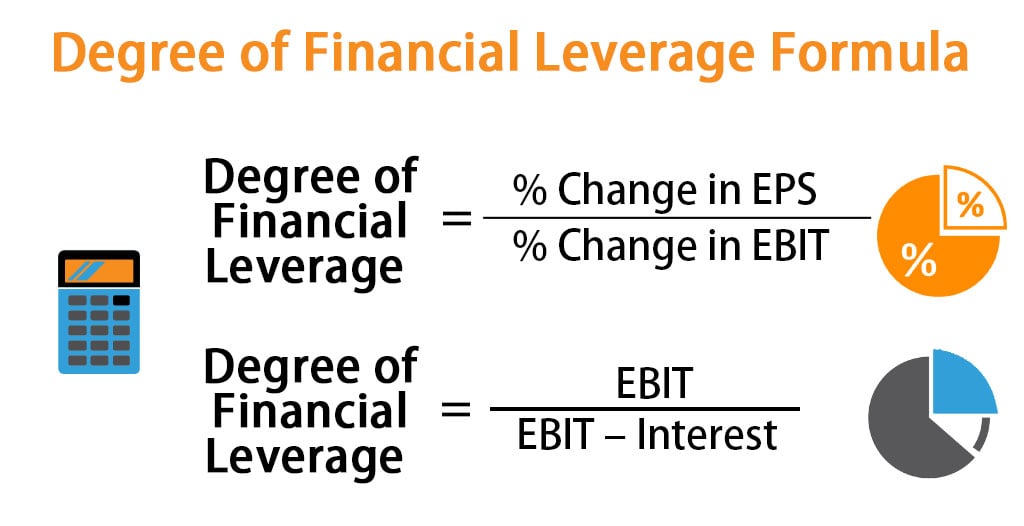

Financial Leverage Formula Calculator Excel Template

How To Calculate Leverage Ratio In Excel Youtube

Leverage Ratio Formula Calculator Excel Template

How To Calculate Margin And Leverage Using Microsoft Excel Youtube

Margin Calculator Calculate Leverage Exposure For All Asset Classes

Degree Of Financial Leverage Formula Calculator Excel Template

Margin Calculator Part 1 Varsity By Zerodha

Leverage Ratio Formula Calculator Excel Template

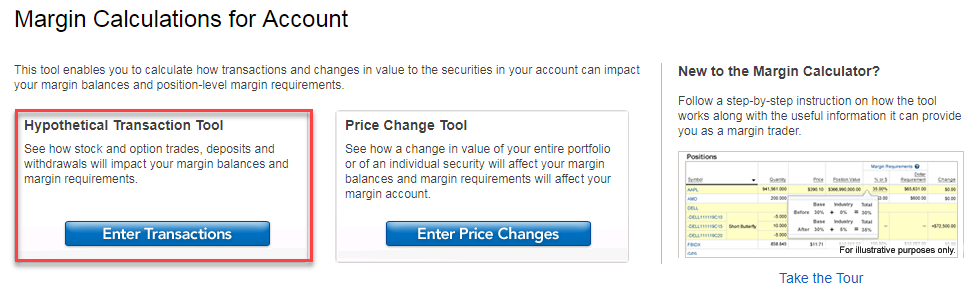

Trading Faqs Margin Fidelity

Leverage Ratio Formula And Calculator Excel Template

Margin Calculator Calculate Leverage Exposure For All Asset Classes